what measures can banks employ to mitigate credit risks?

- Enquiry

- Open Access

- Published:

Impact of gamble management strategies on the credit risk faced by commercial banks of Balochistan

Financial Innovation volume five, Article number:44 (2019) Cite this article

Abstract

This study aims to identify risk management strategies undertaken by the commercial banks of Balochistan, Islamic republic of pakistan, to mitigate or eliminate credit risk. The findings of the study are significant as commercial banks will understand the effectiveness of various risk management strategies and may use them for minimizing credit risk. This explanatory study analyses the opinions of the employees of selected commercial banks about which strategies are useful for mitigating credit risk. Quantitative data was collected from 250 employees of commercial banks to perform multiple regression analyses, which were used for the analysis. The results identified four areas of impact on credit risk management (CRM): corporate governance exerts the greatest bear on, followed by diversification, which plays a significant role, hedging and, finally, the depository financial institution'southward Majuscule Adequacy Ratio. This report highlights these 4 risk management strategies, which are critical for commercial banks to resolve their credit risk.

Introduction

Credit risk causes economical downturn as banks fail due to default risk from clients, which has had a negative impact on the economic development of many nations around the world (Reinhart & Rogoff, 2008). By definition, credit take a chance describes the risk of default past a borrower who fails to repay the money borrowed. The term hedging signals the protection of a business'due south investments by limiting its level of risk, for example, by purchasing an insurance policy. Diversification is the allocation of financial resources in multifariousness of different investments and has also long been understood to minimize such run a risk. The majuscule adequacy ratio is a measure of a bank'south majuscule maintained to blot its outlying risks. Since in that location is a lot of contest among banks to attract customers, therefore, it has triggered several innovations in banking services (Aruwa & Musa, 2014). Regulators also require banks to improve internal governance practices in guild to ensure transparency and ethical standards to keep the customers satisfied with their products and services. Ambiguity in banks' terms and conditions volition get in difficult for customers to select fiscal products advisable for their needs, whereas articulate terms and conditions allow customers to be more satisfied with the bank'due south operation (Ho & Yusoff, 2009). Customers await the financial institutions to take strong policies that tin safeguard their interests and protect them. Therefore, poor understanding of constructive credit hazard and the acceptable risk management strategies past bank managers poses a threat to the commercial banks advancement and customers' interest.

I disquisitional success factor for financial institutions lies in their realization of the importance of credit risk and devising solid strategies – such as hedging, diversification and managing their capital adequacy ratio – to avert shortcomings that could lead to operational ending. Credit risks faced past banks have central touch on the performance considering, even few big customers default on loans would crusade huge problems for it. The objective of the Credit Adventure Management (CRM) procedure is to maximize the price-adjusted rate of return of a particular bank by maintaining exposure to credit risk acceptable to its shareholders. Banks have to navigate the credit adventure associated with the overall portfolio as well as external risks that may be due to macroeconomic factors in the economy. Banks must besides compare the credit risk relationships with other risks. Some other specific example of credit risk applies to the method of trying to settle banking transactions. Until and unless both parties settle their payments in a timely way, bank suffers from opportunity loss. Corporate governance may also have large effect on the risk management strategies used by the banking concern for reducing credit risks. Research suggests that information technology is imperative that banks engage in prior planning in order to avoid time to come issues (Andrews, 1980).

Majority of commercial banks provide several services that could help them mitigate or manage take chances. For example, hedging has been used to reduce the level of risk involved in transactions by keeping specific conditions that would permit different parties to exchange goods or services at a flexible date and time (Harrison & Pliska, 1981). The significance of effective run a risk management strategies have been highlighted by many researchers and practitioners over time to assist banks and other fiscal institutions. CRM became an obvious necessity for commercial banks, particularly after the 2008 global financial crunch, in which it was primarily subprime mortgages that caused a liquidity crunch (Al-Tamimi, 2008). According to Al-Tamimi (2008), ensuring the efficient do of hazard management may not be expensive only the implementation should be done in a timely fashion in order to ensure smoothen cyberbanking operations.

A fiscal institution, just like a elective part of any other major economic sector, aims to come across incurred expenses, increase the return on invested uppercase and maximize the wealth of its shareholders. In their pursuance of these objectives, the fiscal organization has to offer effective risk direction strategies to financial institutions like banks against credit risk (Hakim & Neaime, 2005).

Problem statement

In 2008, across the world, the credit crunch began as a outcome of mass issuing of sub-prime mortgages to individuals in the U.s.a. leading to defaults, which caused outwardly-rippling problems for financial institutions all across the world. Sub-prime mortgages and other loans with less restrictions can generate remarkable losses including corporate failure and defalcation for financial institution (Brownish & Moles, 2014). These credit decisions have a pivotal role in firms' profitability. The decision to over-extend credit to high-risk customers may increment short-term profitability for individual banks, though in aggregate, this lending beliefs was seen to become a major challenge to the risk management structures of the economy as a whole. Therefore, managing run a risk is the most of import element of a bank'southward operations. This phenomenon is every bit applicative to banks across the globe, including banks in Pakistan.

Due to unstable and volatile nature of the political and financial environment in Pakistan, banks are affected by many types of risk, including risks to strange exchange rates, liquidity, operations, credit and involvement rates. Pakistan'due south fiscal institutions are mostly run a risk-balky, especially towards machine financing and mortgage loans in which chances of huge losses are higher (Shafiq & Nasr, 2010). Balochistan is the least developed function with largest geographical expanse in Islamic republic of pakistan. There are limited opportunities for small businesses and majority of businesses are run in breezy form with poor documentation. Majority of commercial banks face problems like loan documents verification and loan processing. Therefore, the adoption of proper risk management strategies can help understand and mitigate the credit run a risk faced past commercial banks of Balochistan.

Research objective

This study aims to identify the dissimilar risk direction strategies that tin can influence the direction of credit hazard by commercial banks. We expect to determine if these strategies contribute both to the reduction of credit risk as well every bit the efficient performance in fulfilling customer needs.

Significance of the written report

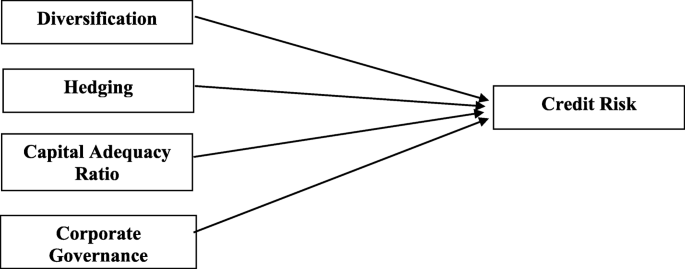

This study aims to provide a basis for guidance for the commercial banks of Balochistan to adopt long-term operation-improving risk management strategies (Campbell, 2007). The model for the study shows the impact of take chances management strategies, including hedging, diversification, the capital adequacy ratio and corporate governance. The research will besides examine the impact of each risk management strategy individually in social club to understand the importance of each strategy. To the best of authors' knowledge, in that location is no study on credit risk management on Balochistan using the described parameters. The findings of this study are intended to contribute positively to guild by demonstrating that the banks of Balochistan can develop effective strategies to improve their CRM. Additionally, policy makers can place and generate appropriate policies to govern banking concern behavior in lodge to minimize take a chance.

Literature review

Credit risk is considered equally the gamble of loss that will occur when the loan or whatsoever other line of credit by a particular debtor is not repaid (Campbell, 2007). Since 2008, fiscal experts around the world have researched and analyzed the chief factors underpinning the credit crunch to identify problematic beliefs and effective solutions that tin help financial institutions avoid catastrophe in the future. Long ago, the Basel Committee on Cyberbanking Supervision Footnote 1 (1999) has as well identified credit risk as potential threat to banking sector and adult certain banking regulations that must be maintained by the banks around the world. Owojori, Akintoye, and Adidu (2011) stated that at that place are legislative inadequacies in financial system especially in banking system that are effective as well as lack of uniform credit information sharing amongst banks. Thus, information technology urges to the fact that banks need to emphasize on better run a risk direction strategies which may protect them in the long run.

Abiola and Olausi (2014) emphasized on the establishment of a separate credit unit at banks with professional staff for credit/loan officers and field officers. It is important as they perform variety of functions from projection appraisals through credit disbursement, loan monitoring to loans collection. Therefore, a comprehensive human resources policy related their pick, training, placement, job evaluation, discipline, and remuneration need to be in placed to avoid any inefficiencies related to loan management and credit defaults.

Ho and Yusoff (2009) focused on researching Malaysian financial institutions and their direction of credit risk. The study involved a sample of 15 strange and domestic financial institutions from which the data was collected through questionnaires. The findings demonstrated that the diversification of loan services leads to run a risk comeback, though it requires training employees and the delivery of employees to ensure that the fiscal establishment volition come across the requirements for all-time practice lending.

Dark-brown and Wang (2002) conducted study virtually the challenges faced by Australian fiscal institutions due to credit risk over the period Jan 1986 to August 1993. The Australian financial institutions were not able to provide a broad variety of alternatives to their clients that led to higher risks as there was a lack of diversification in their services. The inquiry suggested that corporate governance practices allow firms to adopt appropriate rules, policies, and procedures to ensure that the rights of all the stakeholders are fulfilled. Hedging Footnote two is used past financial institutions to minimize the risk associated with the transactions conducted with the banking company customers as information technology allows the bank to minimize the risk by offering flexible offers that allows customer to brand their decisions effectively (Dupire, 1992).

The work of Karoui and Huang (1997) indicates that the super hedging strategy Footnote 3 could be implemented to achieve a surplus downside market risk as it possesses a duality of both the super hedging and open up hedging approaches. The prices of options tin can increase due to the volatility of the nugget prices. If the prices of the financial instrument are fluctuating, then the cost of the options contract might besides be influenced as the buyers or sellers will be deriving their profit from the price of the financial security (Hobson, 1998).

Several factors are associated with the pricing of securities equally these factors support the fiscal decisions that must be made by the investors. The loans that the bank provides to the borrower are highly dependent on the conditions of the market. Decision-making for mitigation and management of credit run a risk is very important for banks (Li, Kou, & Peng, 2016). A highly volatile security market will influence the prices and interest rates of the securities being exchanged in such a market. Financial markets are affected by the macroeconomic variables that influence the prices of the securities being exchanged. Hedging allows firms and their managers to comprise policies that will maximize the value of the company as clients take a broad array of alternatives that allow them to make their decisions in an effective style. The derivatives such as options, futures, forrad and swaps that are used by firms increase their financial stability by assuasive the customers to have sufficient data that improves their decision making in dissimilar circumstances. This enables managers to adopt practices that will do good their organizations. Hedging allows businesses to support a higher debt load due to its flexible nature and ability to minimize adventure, which increases the value of the visitor as it can actually meet the needs of more customers with a comparatively lower level of gamble (Graham & Rogers, 2002). Similarly, Levitt (2004) explained that hedging enables firms to extend its activities because the risk inherent to providing funds is reduced in such transactions, allowing more flexibility to all involved parties.

Banks are able to maintain a detail level of reserved cash for the sake of managing the day to day operations that is decided based on the allocated capital letter capability ratio. This enables the bank to maintain a residual of cash that is sufficient to meet the needs of the customers. Managers can use the bank'southward available greenbacks flow to meet short-term greenbacks requirement needs, which are based on the concept of capital capability ratio. This gives certainty to some funds that banks must maintain in guild to address unforeseen circumstances. The selective hedging concept has been used past firms for the sake of making investments that are based on a sure office of their portfolio that pose the most threat and not the unabridged portfolio of the fiscal instruments (Stulz, 1996). The accent is on utilizing hedging at the right fourth dimension for the specific client that a company believes should exist entering into a contract with flexible terms and atmospheric condition. Information technology is a viable selection for banks to employ hedging to avoid customers' dissatisfaction for those who do not meet the business firm'southward loan eligibility criteria. Zhang, Kou & Peng, (2019) proposed a consensus model that considers the cost and degree of consensus in the group decision making procedure. With a certain degree of consensus the generalized soft cost consensus model was adult by defining the generalized aggregation operator and consensus level function. The price is properly reviewed from the perspective of the individual experts and the moderator. Economic significance of the two soft consensus cost models is also assessed. The usability of the model for the existent-earth context is checked by applying it to a loan consensus scenario that is based on online data from a lending platform. Group decision making is disquisitional for changing the opinions of anybody to arrive at a synchronized strategy for minimizing the risks of the bank with the help of hedging (Zhang, Kou, & Peng, 2019).

Kou, Chao, Peng, Alsaadi & Herrera-Viedma, (2019) identified that financial systemic risk is a major outcome in fiscal systems and economics. Automobile learning methods are employed by researchers that are trying to respond to systemic risks with the help of financial market information. Machine learning methods are used for understanding the outbreak and contagion of the systemic take a chance for improving the current regulations of the financial market and industry. The newspaper studies the research and methodologies on measurement of fiscal systemic risk with the help of large data analysis, sentiment assay and network analysis. Machine learning methods are used along with systematic financial risk management for controlling the overall risks faced by the banks that are related to hedging of the financial instruments of the bank (Kou, Chao, Peng, Alsaadi, & Herrera-Viedma, 2019).

Provision of financial assist to customers that crave the funds for business activity tin prove profitable for the bank (Datta, Rajagopalan, & Rasheed, 1991). If the principle and interest of the loan is repaid in a timely style that would help the banks ensure smooth flow of their operations, and the economic activities in the gild are improved as the standard of living of people besides improves with such financial assistance that is provided by commercial banks (Keats, 1990). Equally banks enter into such contracts with several customers, the level of the its incurred gamble increases; direction as well becomes more circuitous with a more various group of customers (Kargi, 2011). Non-Performing Loans (NPL) represent the credit that a bank believes is causing a loss, and includes loan defaults, which are typically categorized by their expectation of recovery as "standard," "hundred-to-one" or "lost" (Kolapo, Ayeni, & Oke, 2012). The lost category focusing on the inability of the bank to recover item products restricts a banking company from reaching the set targets thus causing a banking concern to fail in attaining the objectives of profitability that have been fix. The incurrence of a large amount of high-gamble debt is often difficult for banks to manage unless the managers have undertaken appropriate strategies for mitigating the take chances in addition to enhancing their financial performance. The existence of NPLs prompted central global banks to enter into the 1988 Basel Accord, also known every bit Basel I (later superseded in 2004 by Basel II), which maintained that banks must maintain a particular amount of uppercase in order to meet their operational needs (Van Greuning & Brajovic Bratanovic, 2009). This on-hand capital requirement, too called the upper-case letter adequacy ratio, is benign every bit it allows banks to more hands manage potential, sudden fiscal losses (Keats, 1990).

Kithinji (2010) provides specific testify that the direction of credit risk does not influence the profitability of banks in Kenya. In fact, the Kargi (2011) study on Nigerian banks from 2004 to 2008 revealed a healthy human relationship between appropriate CRM (Credit Risk Direction) and bank functioning. Poudel (2012) emphasized the significant part played by CRM in the improvement of financial performance of banks in Nepal between 2001 and 2011. Strict requirements of maintaining higher capital that is around 14.3% of the cash balance as reserve in the banks of Nepal was found to accept resulted in better bank performance past producing more profit.

Heffernan (1996) stated that CRM is crucial for predicting proper bank financial performance. A banking concern's inability to recoup its outstanding loans reduces its ability to engage in other profitable transactions A loss both of principle likewise equally involvement (including time value) means also a loss in opportunities to expand and pursue other profitable operations (Berríos, 2013).

Banks that avoid chance management face several challenges, including their own survival in the current highly competitive fiscal environment. To compete successfully with other commercial financial institutions, banks rely on a diversification of products and financial services to better portfolio performance, including attracting more customers. Diversified services allow customers to select the most advisable fiscal assistance in light of their individual needs. Forth with diversification of the financial services, banks demand to manage the credit hazard involved where funds are given every bit loans for diverse needs of the customers such as motorcar loans, firm loans, starting a new business or expanding ongoing business (Kou, Ergu, Lin, & Chen, 2016). It is also important to have effective beliefs monitoring models to ensure that bank employees are careful in minimizing the operational risks by providing maximum information to the customers about the fiscal instruments and the restrictions imposed by the banking concern for the sake of protecting the interests of the financial institution. Chao, Kou, Peng & Alsaadi, (2019) conducted a study to understand a new form of coin laundering that is merchandise based which is using the signboard of international trade. It appears forth with the capital movement that is generally concerned with the rise in the collapse of the overall financial market place. Information technology is difficult to foreclose money laundering since information technology has a plausible sort of merchandise characterization. The aim of the paper is to develop monitoring methods that have accurate recognition along with classified form of supervision of the trade based money laundering with the help of multi class knowledge driven classification algorithms that are linked with the micro and macro prudential regulations. Based on an empirical study from China the application is reviewed and the effectiveness is assessed in order to ameliorate the efficiency of the management in the financial markets (Chao, Kou, Peng, & Alsaadi, 2019).

Selecting the most eligible customers for a loan is also essential to managing credit risk: a bank can screen through a listing of customers to place the ones who have a college probability of repayment within the specified fourth dimension duration, according to the terms and atmospheric condition of the contract. Hentschel and Kothari (1995) emphasized that using different derivatives is significant for the leverage of the financial institution. A vast majority of companies surveyed were using derivatives to reduce their hazard (Kou, Peng, & Wang, 2014). Dolde, (1993) highlighted that several banks are vulnerable to various risks, therefore, banks have undertaken specific precautionary measures like preparation their employees, developing improve credit policies and reviewing the credit rating of the customers applying for the loans (Dolde, 1993).

Diversification is adopted by corporations for increasing the returns of the shareholders and minimizing take a chance. Determination-making criteria is improved by using classifiers that have some algorithms for resolving problems (Kou, Lu, Peng, & Shi, 2012). Rumelt (1974) revealed that simply around xiv% of firms on the Fortune 500 list were working as single business concern organizations in 1974, whereas 86% of the businesses operated in diversified product markets. This shows a considerable inclination of the business sector to emphasize diversification instead of unmarried trade. Much enquiry has been conducted focusing on the activities of companies during recent times; about have found a rise in the prevalence of diversified firms (Datta et al., 1991).

Enquiry hypotheses

The commencement hypothesis considers assessing the role of hedging in reducing a banking concern's credit. Based on a model presented by Felix (2008), which showed risk management strategies of hedging, capital adequacy ratio and diversification may be used to explain credit adventure that a bank faces. Thus our first hypothesis is every bit follows:

H1: hedging will minimize credit run a risk faced by the commercial banks of Balochistan

The second risk management strategy is diversification, which requires banks to provide a wide range of financial services with flexible terms to customers and to provide credit to a wide range of customers instead of few in social club to reduce chance (Fredrick, 2013). The concept of diversification can be used by banks as they create a wide customer pool for providing loans, instead of providing large amount of loans to few customers, which inherently increases take chances (Hobson, 1998). Therefore,

H2: diversification will minimize credit chance of the commercial banks of Balochistan

The tertiary hypothesis considers management strategy that requires banks to maintain a particular amount of the capital (Ho & Yusoff, 2009). The upper-case letter adequacy ratio is critical for banks to be in a improve position to manage unexpected risks and thus capital maintained in a depository financial institution has a consequence at overall credit hazard therefore the it may be hypothesized equally post-obit:

H3: capital adequacy ratio will minimize credit risk of commercial banks of Balochistan

The quaternary hypothesis considers the role played by corporate governance in minimizing credit risk. Corporate governance assumes that the arrangement or corporation should adopt all practices that ensure accountability to the stakeholders (Shafiq & Nasr, 2010). Therefore,

H4: corporate governance volition minimize credit take a chance of the commercial banks of Balochistan

Methodology

This report adopts an explanatory enquiry blueprint, which was aimed to collect accurate, credible and unbiased data. The data were collected from the employees of commercial banks located in the province of Balochistan, Pakistan. All upstanding considerations were made during the research procedure. The questionnaire developed for the drove of information was prepared to effectively incorporate all potential factors that include, diversification, hedging, upper-case letter capability ratio, corporate governance and credit take a chance. The purpose of this research was clearly explained in the questionnaire equally information technology was being shared with the respondents.

The participants were informed almost the research objective and ensured that the information provided would be kept confidential. This stride was designed to remove bias and ensure that the participants were able to share their views without having any reservations. This procedure is of import for accurate results and reliable information (Levitt, 2004).

The sample size for this written report comprised of 250 employees from commercial banks in Balochistan. In that location are large scale commercial banks that operate in Pakistan with several branches of these banks working in the entire land. Commercial banks approached for this study included Habib Bank Limited, Standard Chartered Bank, United Depository financial institution Limited, Elevation Bank, Faisal Bank, Askari Banking concern and Bank Al-Habib.

The questionnaire was adopted from a global survey previously conducted by the World Depository financial institution. This written report analyzed the work that has been done on managing credit risk in several countries in dissimilar parts of the earth. Our questionnaire used the framework of this valuable enquiry tool, adopting changes specific to address the localized context of Balochistan.

The data collected from the participants was analyzed to identify trends and practices in the banks operating in Balochistan to understand the practices of these commercial banks for managing credit risk. Following is the theoretical framework of the study.

The relationships between chance management strategies such every bit diversification, hedging, the capital adequacy ratio and corporate governance with credit risk itself were determined in the paper.

Results & findings

The questionnaire was tested to bank check the reliability through Cronbach's blastoff (Table 1), which shows internal consistency of the instrument; the information revealed that the data are 80% reliable, considering the total of 31 questions asked. The data is essential every bit this shows that the results and findings of the study are reliable and they tin be generalized to the population (Hungerford, 2005).

The correlation table shows the relationship betwixt the dissimilar variables in the research study. The dependent variable, credit risk, was reviewed confronting the independent variables: corporate governance, hedging, diversification and capital letter adequacy ratio. The correlation is essential for further assay equally there should be some relation between the different variables. Each variable is used for the correlation analysis so it highlights the correlation amidst all the variables with each other. This is useful for assessing the correlation amid the contained variables and to ensure that it is not too loftier leading to a problem of multicollinearity.

Table ii shows the results of the correlation exam between the independent variables and the dependent variable. Before running regression analysis, basic assumptions were also checked. Information normality was checked through skewness and kurtosis and for all variables; these values were in range ± two. Linearity was checked through correlation analysis and all variables were shown to have a significant relationship with each other. Homogeneity was checked through besprinkle plot, showing that the variance across all variables was the same. No autocorrelation was found as the value for the Durbin Watson test was 2, showing no correlation among residuals (Antonakis, Bendahan, Jacquart, & Lalive, 2014). The value for the variance inflation gene (VIF) was VIF < 5, which shows no human relationship among the 4 independent variables. The regression test was used to determine the influence of each of the variable on credit chance. The results can be seen in Table 3.

Credit risk can exist influenced past different factors merely, there is effectually 36% influence of the 4 variables that are independent. The variation of 36% can be explained by the contained variables that are hedging, diversification, capital adequacy ratio and corporate governance on credit risk. These factors business relationship for this much change that can exist observed in the credit risk faced past the commercial banks. The adjusted r ii was farther analyzed because it is a meliorate measure for a focused analysis on a bank'south functioning.

Table 4 shows the results of the cess of the data for the overall model goodness of fit; the overall model is highly significant at p < 0.05. The analysis of the variance across the small samples of the information reveals that the overall data is consistent.

The standardized coefficients in Table five show the rate of modify that is acquired by each of the variables in the credit risk of the commercial banks. This is critical information every bit the variable that is having a higher coefficient value will exist having more influence on the level of credit risk so it should be emphasized more than by the commercial banks for the sake of achieving better performance. The regression analysis highlights that the four independent variables accept an bear on on credit risk.

$$ {\mathrm{CR}}_{\mathrm{t}}=\upalpha +{\upbeta}_1\mathrm{CG}+{\upbeta}_2\mathrm{DVF}+{\upbeta}_3\mathrm{HDG}+{\upbeta}_4\mathrm{Car}+\upmu $$

$$ \mathrm{CR}=1.765+0.288\mathrm{CG}+0.263\mathrm{DVF}+0.250\mathrm{HDG}+0.040\mathrm{Machine}+0.237 $$

The results reveal that corporate governance had the most impact on credit hazard (with a 0.288 standardized beta value). In other words, this CRM strategy appears to exist the almost beneficial for commercial banks to undertake. Next is diversification (0.263 beta), followed by hedging (0.250 beta) and, finally, the capital adequacy ratio (0.040 beta). The results are pregnant in is showing that these variables have an impact on credit risk. The constant value was calculated at 1.765 and the error term in the equation is 0.237.

Recommendations

The banks in Balochistan would do good from adopting audio strategies to improve control over credit take chances. CRM strategies such as diversification, hedging, corporate governance and the capital capability ratio accept all been cited in extant inquiry as being crucial for the success in this regard; in fact, many problems arising from credit take chances can exist resolved by implementing some combination of these strategies. The research findings tin can too help the government of Balochistan to ensure that commercial banks accept advisable risk management measures to assistance keep them from failures, such as falling into bankruptcy (Greuning & Bratanovic, 2009). Society depends on the shine functioning of the banking sector, and then individual (and aggregate) depository financial institution operation can help contribute to the development and improved welfare of the economy. Therefore, effective inspection should be employed by the banks to check and safeguard depository financial institution resources. Effective trainings and refresher courses should be giving to bank employees in the areas of take chances asset management, risk control and credit utilization in society to ensure proper usage and performance.

Conclusion

Several banks accept failed in the past equally they were not able to control their credit gamble. Recommendations for banks stemming from this study include the diversification of their products and services, which is disquisitional as it allows the depository financial institution to provide customers with many products and services. After diversification, an emphasis on employing corporate governance policies is almost of import, co-ordinate to the findings. Hedging and the upper-case letter capability ratio are also important strategies that tin can exist examined and optimized by banks. Hedging is useful because inbound into flexible contracts helps reduce risk. The banks in Balochistan will be able to realize the importance of the capital adequacy ratio as that will let them to accomplish a proper rest betwixt the amounts of uppercase that should be maintained to manage the needs of the investors. It is recommended that farther research on the topic should be conducted so that effective strategies for direction of other risks can be identified for banks. The success and farther progress of these banks depend on the smooth implementation of risk management strategies and activities, which have been shown to have a very meaning positive touch on on the power of the banks of Balochistan to control credit risk.

Availability of data and materials

The information of the inquiry paper will be bachelor upon request.

Notes

-

This is a place in Switzerland where the Basel Committee on Banking Supervision (BCBS) comprising of 45 members from 28 Jurisdictions, consisting of Central Banks and regime have the responsibleness of banking regulation.

-

Hedging are flexible contracts that let customers to agree to buy a particular product in future date using spot rates. Information technology allows customers and banks to manage the transaction past locking contracts at desired toll.

-

Super hedging strategy allows the users to hedge their positions with a trading plan based on self-financing. A low price is paid for the portfolio that would ensure that it's worth to exist equal or higher at a hereafter engagement.

Abbreviations

- CAMEL:

-

Majuscule adequacy, asset quality, management, earning, liquidity and sensitivity

- Motorcar:

-

Uppercase adequacy ratio

- CG:

-

Corporate governance

- CRM:

-

Credit hazard management

- DVF:

-

Diversification

- HDG:

-

Hedging

- NPL:

-

Non-performing loans

References

-

Abiola I, Olausi AS (2014) The impact of credit risk management on the commercial banks performance in Nigeria. International Journal of Management and Sustainability 3(5):295–306

-

Al-Tamimi H (2008) Implementing Basel II: an investigation of the UAE banks' Basel Ii preparations. J Financ Regul Compliance sixteen(two):173–187

-

Andrews KR (1980) The concept of corporate strategy, Richard D. Irwin. Inc. Homewood. Illinois

-

Antonakis J, Bendahan S, Jacquart P, & Lalive R (2014). Causality and endogeneity: Problems and solutions. New York: Oxford University Printing.

-

Aruwa S, Musa AO (2014) Risk components and the financial performance of deposit money banks in Nigeria. Int J Soc Sci Entrepreneurship ane(11):514–522

-

Berríos MR (2013) The relationship between bank credit risk and profitability and liquidity. The Int J Bus Finance Res vii(3):105–118

-

Brown, Wang S (2002) Credit hazard: the example of outset interstate Bankcorp. Int Rev Financ Anal eleven(2):229–248

-

Brown, Moles (eds) (2014) Credit risk management. Edinburgh, Edinburgh Business Schoolhouse, Heriot-Watt University

-

Campbell A (2007) Bank insolvency and the problem of nonperforming loans. J Banking concern Regul 9(i):25–45

-

Chao X, Kou K, Peng Y, Alsaadi FE (2019). Behavior monitoring methods for merchandise-based money laundering integrating macro and micro prudential regulation: a instance from China. Technol Econ Dev Econ 25(6): 1081-1096

-

Datta DK, Rajagopalan N, Rasheed AMA (1991) Diversification and operation: disquisitional review and future directions*. J Manag Stud 28(5):529–558. https://doi.org/x.1111/j.1467-6486.1991.tb00767.x

-

Dolde W (1993) Utilise of foreign substitution and interest rate take chances direction in large firms. Univ Conn Sch Bus Adm Working Pap:93–042

-

Dupire, B. (1992). Arbitrage pricing with stochastic volatility. Société Générale

-

Felix (2008) Banking company functioning and credit risk direction: unpublished masters dissertation in finance. University of Skovde, Skovde

-

Fredrick O (2013) The impact of credit risk management on fiscal operation of commercial banks in Kenya. DBA Afr Manage Rev 3(i)

-

Graham JR, Rogers DA (2002) Practise firms hedge in response to tax incentives? J Financ 57(ii):815–839

-

Greuning, & Bratanovic. (2009) Analyzing Cyberbanking Take chances A Framework for Assessing Corporate Governance and Financial Risk. Washington D.C.: The World Depository financial institution

-

Hakim S, Neaime S (2005) Profitability and take chances direction in banking: a comparative assay of Arab republic of egypt and Lebanese republic Money and Finance in the Middle East: Missed Oportunities or Futurity Prospects? (Vol. half-dozen, pp. 117-131). Bingley: Emerald Group publishing limited

-

Harrison JM, Pliska SR (1981) Martingales and stochastic integrals in the theory of continuous trading. Stoch Procedure Appl 11(3):215–260

-

Heffernan S (1996) Современное банковское дело в теории и на практике (Mod Banking in Theory and Practise)

-

Hentschel L, Kothari S (1995) Life insurance or lottery: are corporations managing or taking risks with derivatives? Available at SSRN 6351

-

Ho CSF, Yusoff NI (2009) A Preliminary Study on Credit Risk Management Strategies of Selected Financial Institution in Malaysia. Jurnal Pengurusan(28 ), pp. 45–65

-

Hobson DG (1998) Robust hedging of the lookback choice. Finance and Stochastics two(4):329–347.

-

Hungerford T (2005) Is fiscal risk adequately accounted for in social security reform measures? Issue Brief (Public Policy Institute (American Association of Retired Persons))(IB74), 1

-

Kargi HS (2011) Credit risk and the performance of Nigerian banks. Zaria, Ahmadu Bello University

-

Karoui N, Huang S (1997) A general result of existence and uniqueness of backward stochastic differential equations. In: Pitman Research Notes in Mathematics Series, pp 27–38

-

Keats BW (1990) Diversification and business organisation economic performance revisited: bug of measurement and causality. J Manag 16(one):61–72

-

Kithinji AM (2010) Credit risk management and profitability of commercial banks in Kenya

-

Kolapo T, Ayeni R, Oke O (2012) Credit hazard management and banks performance. Aust J Double-decker Manag Res two(2):31–38

-

Kou, Chao X, Peng Y, Alsaadi Iron, Herrera-Viedma Due east (2019) Machine learning methods for systemic risk analysis in financial sectors. Technol Econ Dev Econ:one–27

-

Kou Ergu D, Lin C, Chen Y (2016) Pairwise comparing matrix in multiple criteria determination making. Technol Econ Dev Econ 22(v):738–765

-

Kou, Lu Y, Peng Y, Shi Y (2012) Evaluation of classification algorithms using MCDM and rank correlation. Int J Inf Technol Decis Mak 11(01):197–225

-

Kou, Peng Y, Wang Chiliad (2014) Evaluation of clustering algorithms for financial hazard assay using MCDM methods. Inf Sci 275:1–12

-

Levitt J (2004) Transfer of financial run a risk and culling financing solutions. J Health Care Finance 30(iv):21–32

-

Li Grand, Kou M, Peng Y (2016) A group decision making model for integrating heterogeneous data. IEEE Trans on Syst, Man, and Cybern: Syst 48(vi):982–992

-

Owojori AA, Akintoye IR, Adidu FA (2011) The challenge of risk management in Nigerian banks in the mail consolidation era. J.Account Taxation iii(2):23–31

-

Poudel RPS (2012) The affect of credit hazard management on financial functioning of commercial banks in Nepal. Int J Arts Commerce 1(five):nine–15

-

Reinhart CM, Rogoff KS (2008) Is the 2007 U.s.a. sub-prime financial crisis then different? An international historical comparison. Am Econ Rev 98(2):339–344

-

Rumelt RP (1974) Strategy, structure, and economic performance

-

Shafiq A, Nasr 1000 (2010) Risk management practices followed by the commercial banks in Pakistan. Int Rev Bus Res Pap six(2):308–325

-

Stulz RM (1996) Rethinking adventure direction. J Appl Corp Finance 9(3):8–25

-

Van Greuning H, Brajovic Bratanovic S (2009) Analyzing Banking Chance A Framework for Assessing Corporate Governance and Financial Take a chance. The World Banking company

-

Zhang H, Kou 1000, Peng Y (2019) Soft consensus cost models for group decision making and economical interpretations. Eur J Oper Res 277(3):964–980

Acknowledgements

We are grateful to all the reviewers who accept shared their valuable comments and suggestions for the research paper. The Editorial Board of Financial Innovation has been extremely kind in their editorial efforts.

Funding

There was no funding required for the completion of the research paper.

Author information

Affiliations

Contributions

NM is the corresponding writer and he has likewise given the idea for the paper. NM has reviewed the theoretical framework and empirical analysis of the research paper. ZR has written the manuscript and collected the data for the paper. BS has reviewed the methodology of the paper and reviewed literature. MAR has given conception communication and edited the newspaper. All authors have read the newspaper and approved the final manuscript.

Corresponding writer

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Boosted information

Publisher'south Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open up Admission This article is distributed nether the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in whatever medium, provided you give advisable credit to the original author(s) and the source, provide a link to the Creative Eatables license, and indicate if changes were fabricated.

Reprints and Permissions

About this commodity

Cite this article

Rehman, Z.U., Muhammad, North., Sarwar, B. et al. Impact of take chances direction strategies on the credit risk faced by commercial banks of Balochistan. Financ Innov 5, 44 (2019). https://doi.org/10.1186/s40854-019-0159-8

-

Received:

-

Accepted:

-

Published:

-

DOI : https://doi.org/10.1186/s40854-019-0159-eight

Keywords

- Credit risk

- Risk management strategies

- Financial risk

- Capital adequacy ratio

- Hedging

- Corporate governance

- Diversification

briscoebetimesely.blogspot.com

Source: https://jfin-swufe.springeropen.com/articles/10.1186/s40854-019-0159-8

0 Response to "what measures can banks employ to mitigate credit risks?"

Post a Comment